Macronix's 2H19 revenue/earnings is expected to increase HoH

鉅亨網編譯凌郁涵

Macronix (2337-TW) held an online investors conference today on July 25th. The company’s general manager Chih-Yuan Lu (盧志遠) told that since the company has entered its peak season in 3Q19, the shipment is expected to grow QoQ. In addition, its 2H19 revenue/earnings is expected to increase HoH. Moreover, the demand of NAND Flash and NOR Flash demand has increased. NAND price have rebounded and NOR price remain stable. SLC NAND is progressing smoothly and is expected to start mass production and contribute revenue in 3Q19.

Macronix "s capacity utilization rate in 2Q19 is about 94%. In 3Q19, Lu said that since typical peak season of various product lines has arrived, the shipment is expected to grow QoQ. And, its 2H19 revenue/earning is expected to increase HoH.

In addition to the inventory pull-in of ROM from major clients, Lu pointed out that the demand for NAND Flash and NOR Flash has also increased. And, NAND price has rebounded and NOR price remains stable. The foundry business is expected to continue to grow, catalyzed by the demand growth of ICs and consumer products.

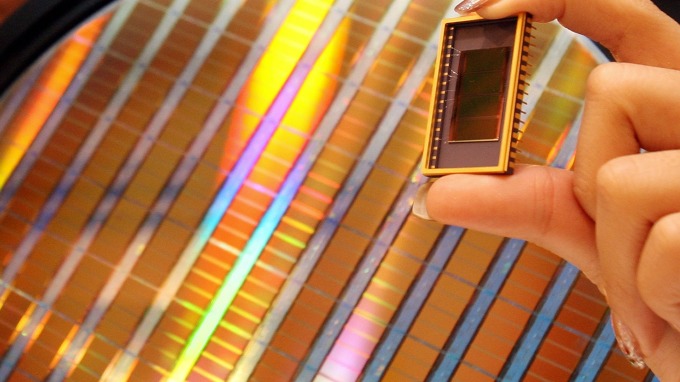

Regarding wafer processing, in terms of NAND Flash, the company plans to upgrade the 12”process from 36nm to 19nm, and upgrade Nor Flash from 75nm to 55nm. Its 19nm SLC NAND has been sent for clients’ approval at the moment and most of which have been certified. It is expected to start mass production and contribute revenue in 3Q19.

- 解讀利率、匯率 揭金融市場劇烈震盪真相!

- 掌握全球財經資訊點我下載APP

鉅亨贏指標

了解更多#偏強減碼股

#波段上揚股

延伸閱讀

- 講座

- 公告

上一篇

下一篇